Discover Our

Wide Range of Web3 Security Tools

Comprehensive security tools for protecting your investments in the Decentralized Financial landscape

Book a DemoYour One Stop Shop For Portfolio Management

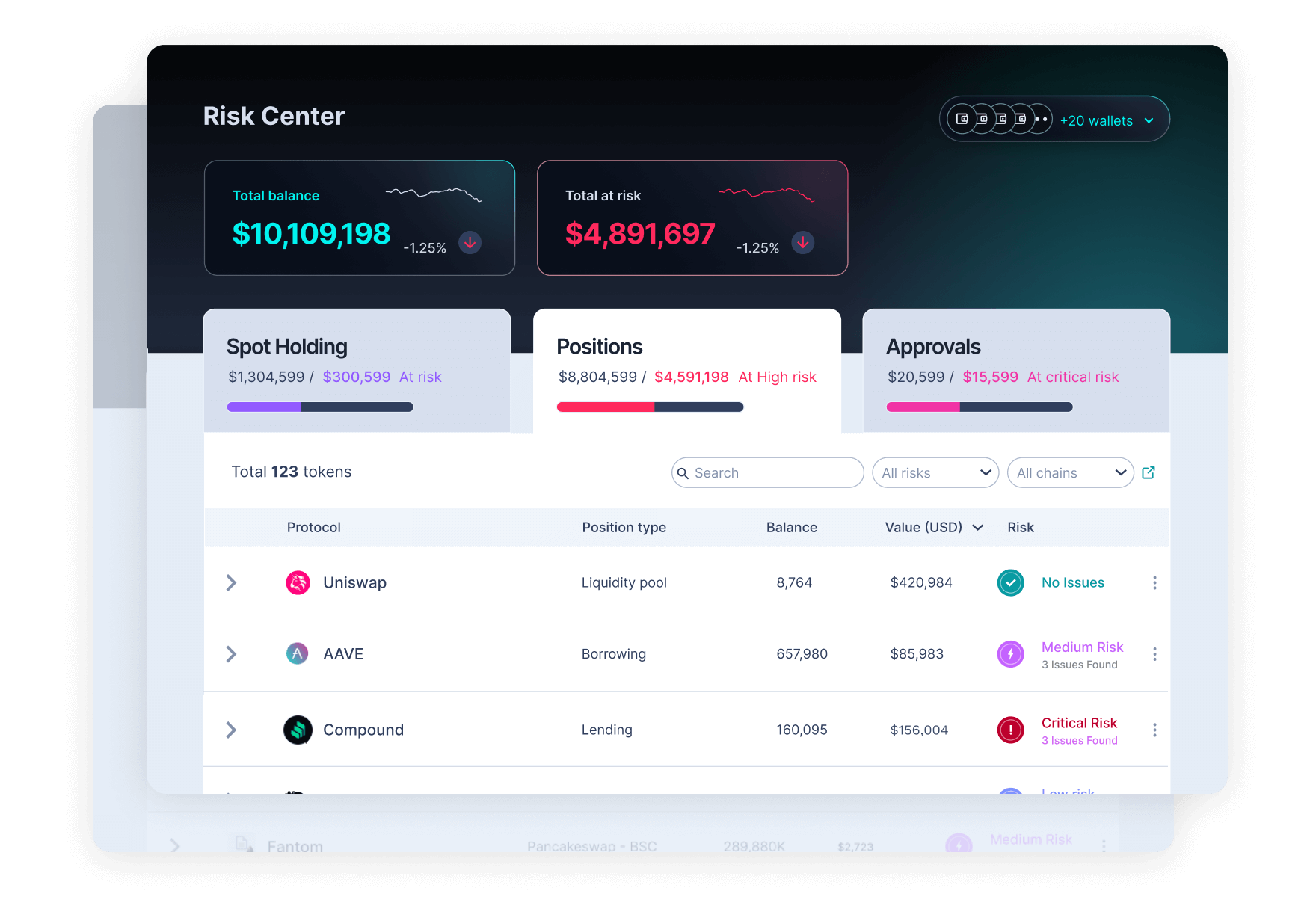

The Risk Center for institutional DeFi funds is a powerful dashboard that consolidates data from multiple wallets, and chains, enabling you to visualize your entire portfolio and associated risk metrics in one place.

Book A Demo

Holistic portfolio view across wallets and chains

View your spot holdings, positions, and associated risks in one place.

One Click Setup

Simply connect your wallets and Redefine will continuously map your open positions, spot holdings, changes, related contracts, and governance protocols for your portfolio.

Understand and Manage Open Approvals

View risk analysis on your open approvals and revoke permissions on a case by case basis or all at once.

Regulatory Compliance

Ensure and demonstrate regulatory compliance effortlessly. Make sure that you’re not interacting with sanctioned addresses unknowingly.

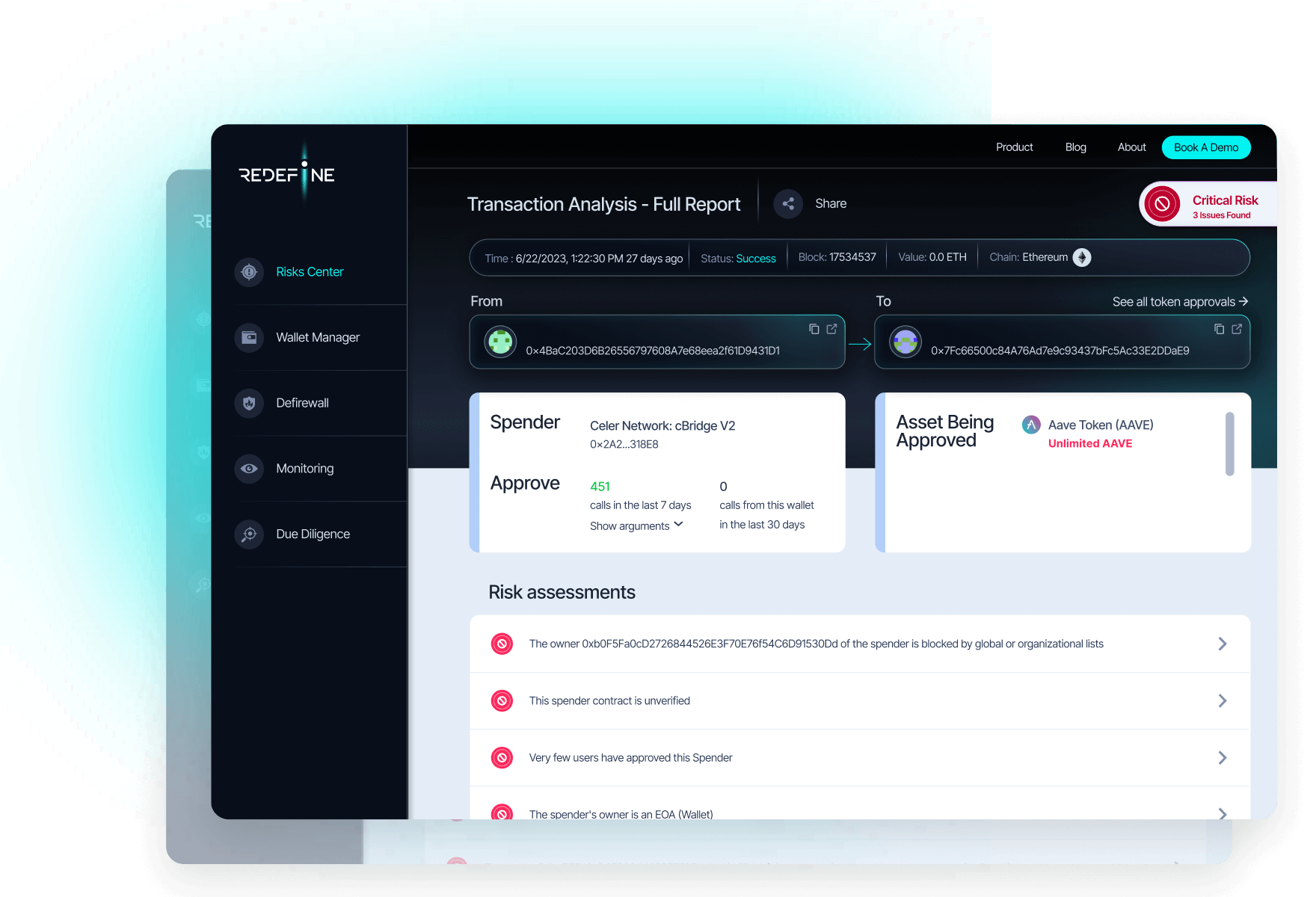

Understand Every Transaction Before You Sign It

Secure your transactions with easy to understand risk analysis and recommended actions

Book A Demo

Comprehensive Risk Assessment

Our advanced insight engine provides a detailed risk assessment based on policies crafted by top DeFi and blockchain experts.

User-Friendly Interface

Our intuitive tool provides detailed risk assessment in an easy to understand format to enable informed decision making.

Thorough Transaction Analysis

Dive deep into transactions with tools that examine meta-calls, events, traces, and all involved contracts and method calls for comprehensive insights.

Auditable History Log

Keeps risk related transactional information for audit to allow for better internal controls

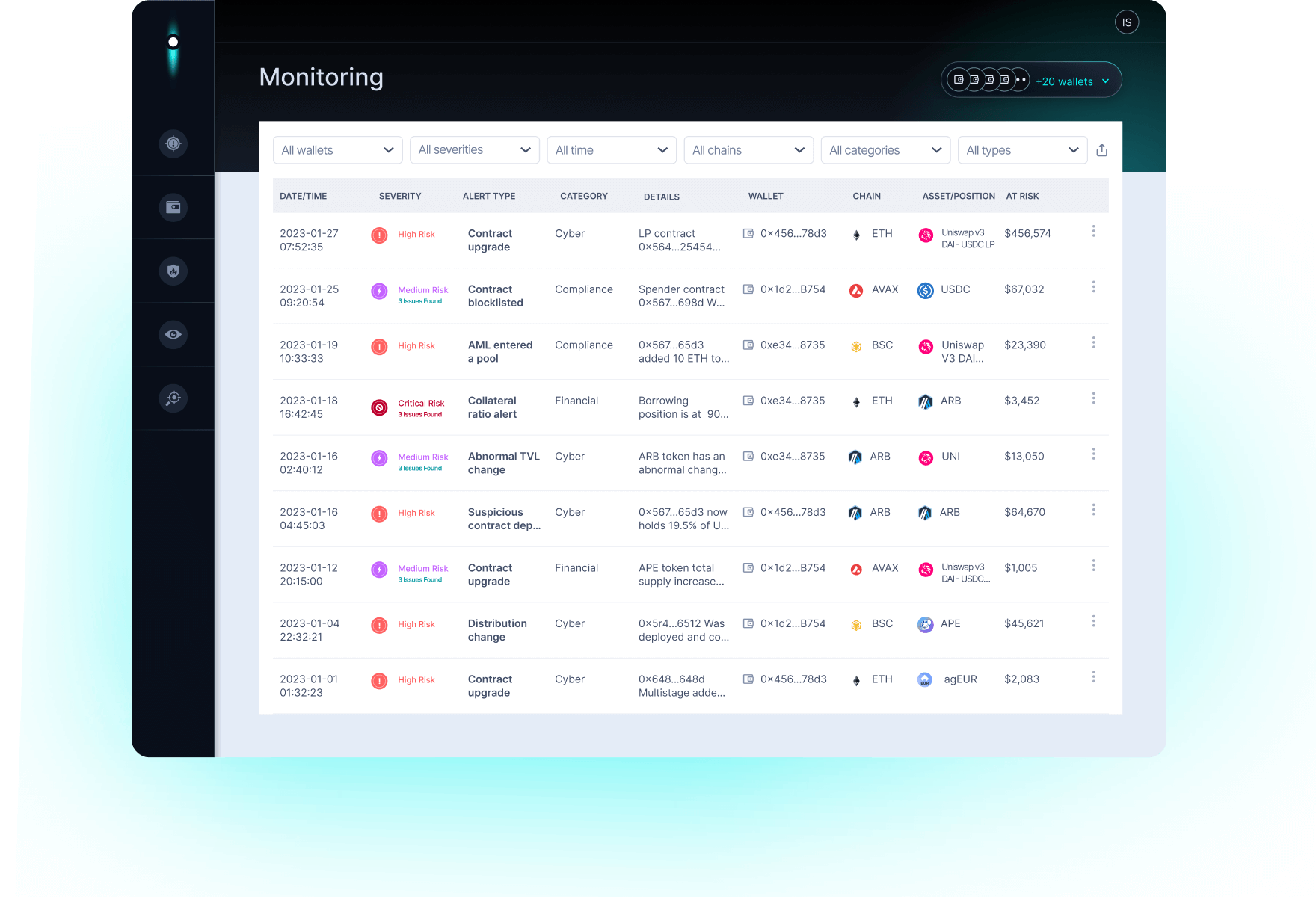

24/7 Protection for Your On-Chain Positions

Our cutting-edge monitoring tool watches over your positions and all dependencies including contracts, liquidity pools, governance protocols, and more. Risk changes in your portfolio trigger real time alerts so that you can protect yourself.

Book A Demo

Real-time Alerts

Stay ahead of potential attacks with instant notifications. Receive personalized cyber, financial, and compliance related alerts based on your portfolio.

Automated Setup

Just add your wallet, and our system will automatically detect your positions along with all relevant contracts that can impact your funds. New positions are automatically detected and monitored.

Configurable Alerts

Tailor your alerts to your precise needs. Alerts are automatically set up but can be completely reconfigured at any time.

Eliminate Noise - Receive Alerts That Matter

Our security team designed alerts to only trigger in response to important risks - when you get an alert, you know it matters.

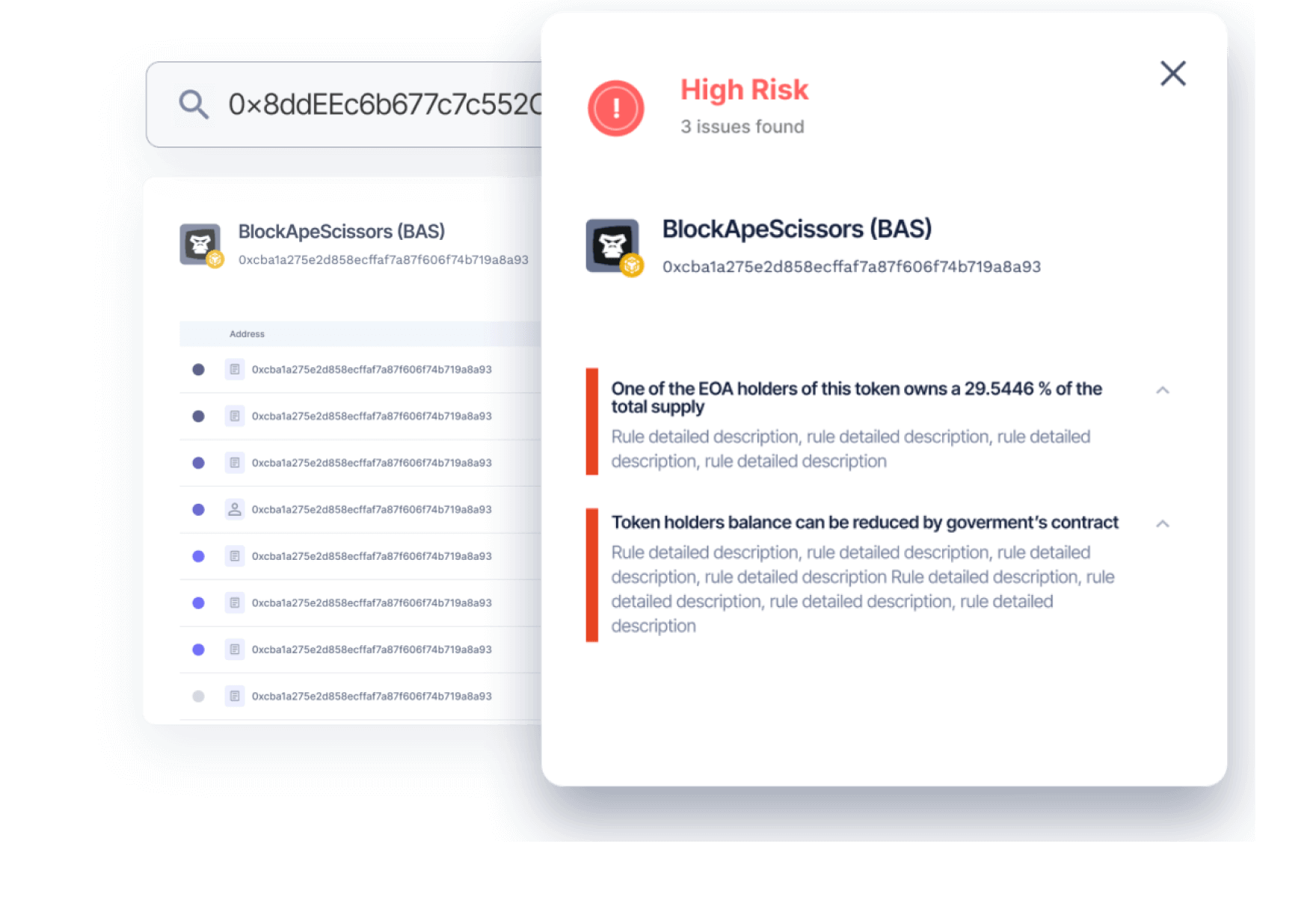

Your Counterparty Risk Analysis

Our Due Diligence tool helps you easily evaluate the legitimacy of blockchain projects, smart contracts, and wallets, so you can make informed investment decisions securely.

Book A Demo

Complete Token Validation

Validate tokens comprehensively, assessing risks and vulnerabilities. View token distribution and associated risk assessments.

Smart Contract Insights

Understand smart contracts thoroughly, detecting vulnerabilities and past issues. Access historical and usage data for secure DeFi transactions.

Instant EOA Reputation Analysis

Discover the history and reputation of Externally Owned Accounts instantly. Investigate EOAs and multisigs with detailed data on their DeFi history.

Automatically Executed Attack Prevention

DeFi Dome offers automated security in the Web3 world using predetermined customized exit strategies. When DeFi Dome identifies severe risks, it automatically executes the exit strategy on your behalf to safeguard your assets.

Book A Demo

Customizable Exit Strategies

Set triggers, and tailor your exit strategies to your specific risk tolerance and investment goals, ensuring precision in risk management.

Automated Execution

DeFi Dome is triggered when major risks arise. It then executes pre-signed transactions defined in your exit strategy and moves your funds to a designated wallet.

Non Custodial Solution

Automated non custodial attack prevention means that your exit strategies are executed on your behalf without you ever needing to share your private keys with us.